Take Home Pay Calculator

Federal Income Tax – How It Affects Your Paycheck

There’s a lot to understand about federal income tax and how it impacts your paycheck. As you work hard for your earnings, it’s important to know how much will stay with you and how much will be withheld for taxes. This blog post will break down how federal income tax affects your take-home pay, helping…

State Income Tax – Key Differences by State

Most people don’t realize how state income tax rates can significantly impact your financial well-being. Understanding the key differences in tax structures among states is important for making informed decisions about where you live and work. From no income tax states to those with steep progressive brackets, each state has its own unique regulations that…

Hourly Wage – How to Calculate, Compare, and Maximize It

Calculate your hourly wage accurately to ensure you’re fairly compensated for your work. This guide will help you determine your wage, understand how it stacks up against others in your field, and explore strategies to maximize your earning potential. By focusing on key factors such as industry standards, geographic location, and your unique skills, you…

Salary vs Hourly Pay – Which One Is Right for You?

Most people grapple with the decision between salary and hourly pay when considering their career options, and understanding the implications of each can significantly affect your financial health and job satisfaction. Salary positions often come with benefits like stability and paid time off, while hourly roles might offer flexibility and the potential for overtime pay….

U.S. Tax Brackets – What They Are and How They Work

Many taxpayers find the U.S. tax system confusing, especially when it comes to understanding tax brackets. These brackets determine how much you owe in federal income taxes based on your taxable income. Knowing how tax brackets work can help you plan your finances and maximize your deductions, thereby potentially lowering your overall tax burden. In…

Social Security & Medicare – What Gets Deducted and Why

Over the course of your working life, understanding the deductions from your paycheck for Social Security and Medicare is necessary for effective financial planning. These deductions not only fund important benefits for your retirement but also provide necessary healthcare coverage in your later years. In this guide, you will learn what specific amounts are deducted…

Pay Frequency Explained – Weekly, Biweekly, Monthly

Most people encounter different pay frequencies in their careers, and understanding these can significantly impact your financial planning. Weekly, biweekly, and monthly pay schedules each have their own benefits and drawbacks, influencing how you manage your budget and cash flow. Knowing how often you receive your paycheck helps you align your expenses with your income,…

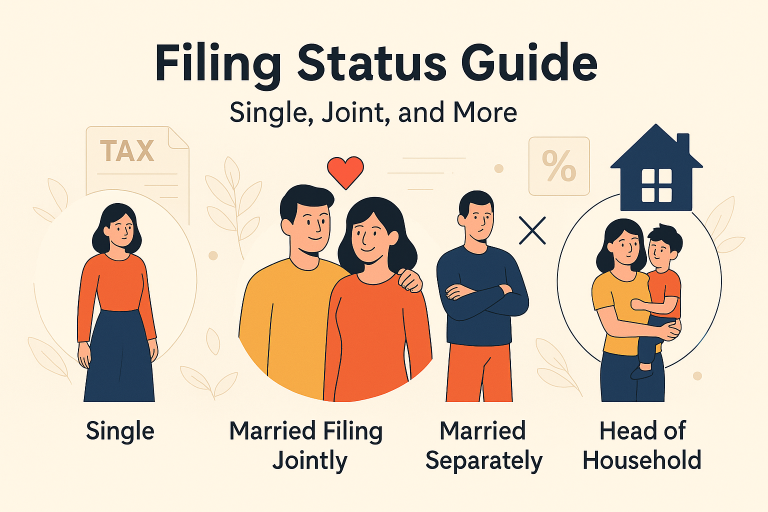

Filing Status Guide – Single, Joint, and More

Most taxpayers find themselves confused about their filing status, which can significantly impact your tax obligations and potential refunds. Understanding whether to file as Single, Married Filing Jointly, or any other status is important for maximizing your benefits and complying with tax laws. This guide will walk you through the nuances of each filing status,…

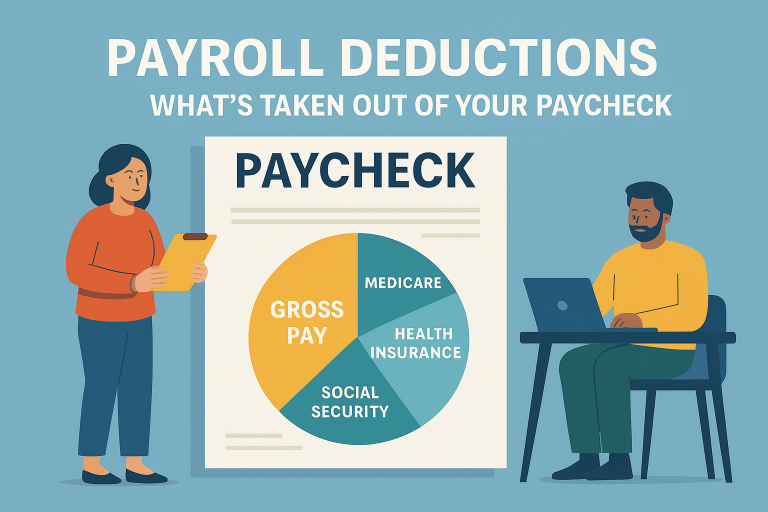

Payroll Deductions – What’s Taken Out of Your Paycheck

Many employees find themselves puzzled by payroll deductions and what exactly is being taken out of your paycheck each pay period. Understanding these deductions is important, as they influence your take-home pay and overall financial planning. From mandatory taxes to optional contributions, knowing what’s deducted helps you make informed decisions about your finances. In this…

401(k) & Retirement – How Contributions Impact Net Pay

Retirement planning can significantly affect your financial future, especially when considering how 401(k) contributions impact your net pay. Understanding the balance between saving for retirement and managing your take-home income is vital. When you contribute to a 401(k), you not only set yourself up for a more secure retirement but also make immediate adjustments to…

Relocation Impact – How Moving Affects Your Take-Home Pay

Income can vary significantly based on where you live, and understanding how relocation impacts your taxes is important for your financial planning. As you consider moving for a new job or lifestyle, it’s important to recognize how changes in state taxes, cost of living, and potential deductions can influence your take-home pay. This guide will…

Navigating Net Pay Calculators: Why They Matter

Understanding Your Take-Home Pay Calculating your take-home pay might seem straightforward, but the implications of these figures can be profound. Net pay calculators allow you to input your gross income, tax deductions, and other factors so you can see a breakdown of what ultimately makes it to your bank account. This clarity can help you…