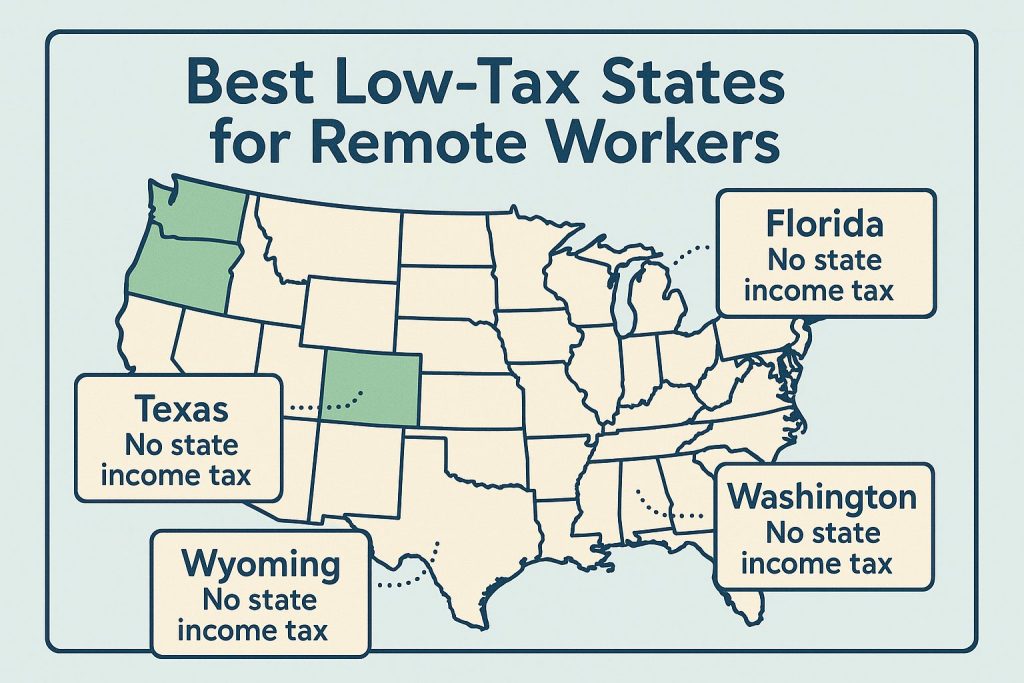

Best Low-Tax States for Remote Workers

States with low tax rates are increasingly appealing to remote workers seeking to maximize their income. If you are considering moving to a new state or simply want to explore your options, knowing which locations offer favorable tax climates can significantly impact your finances. Many states do not impose state income taxes, while others provide deductions and credits that can benefit your bottom line. This guide will highlight the best low-tax states where you can enhance your earning potential while enjoying the flexibility that remote work brings.

Key Takeaways:

- States like Florida, Texas, and Wyoming have no state income tax, making them attractive for remote workers looking to maximize their take-home pay.

- Some states offer lower overall tax burdens through reduced sales or property taxes, contributing to overall cost of living savings for remote employees.

- Considering the quality of life, amenities, and tax structure is important when evaluating the best states for remote work opportunities.

The Tax Landscape: What Remote Workers Should Know

The tax landscape can significantly impact your decision to work remotely from a different state. Understanding how each state taxes income, sales, and property is important for optimizing your financial situation. Income tax structures vary widely; some states have no income tax at all, while others may impose rates exceeding 10%. Moreover, aspect like sales taxes and property taxes can occasionally counteract any income tax savings you find in your chosen locale. Assessing these factors will enable you to make an informed choice about where to establish your remote workbase.

Understanding State Income Tax Structures

Each state’s income tax structure can range from having no tax to progressive rates that climb steeply with your earnings. For instance, Florida and Texas are appealing for remote workers due to their zero income tax, while California has progressive rates that can reach 13.3% for high earners. Some states also offer attractive credits or deductions to lower your effective rate. Evaluating your potential income and lifestyle can help you select a state that aligns with your financial goals.

The Impact of Sales and Property Taxes on Remote Work

Sales and property taxes can play a significant role in your overall tax burden as a remote worker. High sales tax can erode your purchasing power, making everyday items more expensive, while property taxes can affect your housing decisions and investment potential. States like New Hampshire, known for their absence of a sales tax, can enhance your budget for living expenses, whereas property-heavy states might present hidden costs that diminish potential savings from lower income tax rates. Expanding on the impact of sales and property taxes, many states generate substantial revenue through these taxes, which can directly impact your lifestyle. For instance, if you live in a state with a high sales tax, every purchase—from groceries to services—incurs an additional financial burden. Furthermore, property taxes can vary dramatically within a state, making it imperative to research local rates before committing to a move. Consider that New Jersey has some of the highest property taxes in the nation, averaging $8,000 per year on a median home value. Balancing these taxes with potential income tax savings is a vital part of your financial planning as a remote worker.

Top Contenders: States with the Lowest Tax Burden

Choosing a low-tax state can dramatically impact your financial health as a remote worker. Among the Top States for Remote Work Success and Productivity, several stand out based on their minimal tax burdens, allowing you to keep more of your hard-earned money. These states offer various benefits, from no state income tax to favorable overall tax structures.

Florida: Sunshine and Savings

Florida draws remote workers not just for its beautiful beaches and sunny weather, but also its zero state income tax. This means you get to enjoy your full salary without the typical deductions most states impose. Additionally, Florida has a lower property tax rate than the national average, making it an attractive place for those looking to save while enjoying a vibrant lifestyle.

Texas: Big Opportunities, No State Income Tax

In Texas, you can enjoy the benefits of a booming economy without the burden of a state income tax. The Lone Star State not only fosters a thriving business environment but also offers diverse living options from bustling cities to serene rural areas. You can focus on growing your career or business without worrying about high tax rates eating into your income.

In 2022, the Texas economy saw a GDP growth of 5.9%, making it one of the fastest-growing states in the country. The absence of state income tax allows you to maximize your earnings, bolstered by a lower cost of living in many areas. With ample job opportunities, especially in technology and energy sectors, Texas is an enticing place for remote workers looking to build their careers while enjoying financial freedom.

Wyoming: The Hidden Gem for Remote Professionals

Wyoming is quickly emerging as a hidden gem for remote professionals seeking a low-tax environment. With no state income tax and a business-friendly atmosphere, Wyoming is perfect for maximizing your earnings while getting great access to nature and outdoor activities. Its friendly communities and lower living costs make it an appealing option for those pursuing a balanced lifestyle.

The state boasts a unique combination of low taxes and stunning natural scenery, including Yellowstone National Park and the Grand Teton Mountains. With a population that values outdoor activities and a supportive small-business environment, you’ll find it easy to connect with like-minded individuals while enjoying low-stress living. As remote work continues to expand, Wyoming offers a unique blend of financial and lifestyle advantages.

Beyond Taxes: Quality of Life Considerations

While minimizing your tax burden is necessary, the overall quality of life you experience in a new state is equally important. Factors like cost of living, housing affordability, and access to necessary amenities can significantly enhance your daily life satisfaction. Choosing a low-tax state should go hand-in-hand with understanding how that state aligns with your lifestyle preferences and needs.

Cost of Living and Housing Affordability

Cost of living varies widely among the low-tax states, with affordability playing a key role in your overall financial health. States like Texas and Tennessee offer relatively low housing costs compared to national averages, allowing you to stretch your earnings further. For example, in cities like Austin or Nashville, you can find quality housing options without breaking the bank.

Accessibility to Amenities and Services

Access to amenities and necessary services profoundly influences your quality of life. States that excel in this regard often have vibrant communities with excellent schools, healthcare systems, and recreational activities. For instance, Florida not only boasts thriving cultural attractions but also provides easy access to outdoor pursuits such as beaches and parks.

In particular, having proximity to top-notch grocery stores, healthcare facilities, and recreational spots enhances your day-to-day living experience. Consider states like Colorado, where you can enjoy picturesque mountain landscapes along with modern conveniences like shopping malls, efficient public transport, and diverse dining options. These elements collectively create a fulfilling lifestyle, making your transition as a remote worker much smoother.

Discover more about salary comparison after relocating to enhance your knowledge.

How to Choose the Right State for Your Remote Lifestyle

Finding the perfect state for your remote lifestyle requires a blend of personal preference and financial savvy. Begin by evaluating your income needs, housing options, and quality of life metrics to determine which factors matter most. Tax benefits might be appealing, but also consider the overall cost of living, climate, and recreational opportunities available to enrich your working experience.

Evaluating Personal and Professional Priorities

Identify what drives you professionally while also considering lifestyle factors. You might prioritize lower living costs or better work-life balance, which can all influence your choice of state. For instance, areas with a more robust job market in your field can offer growth even as a remote worker.

Considering Community and Networking Opportunities

Your professional growth is often linked to your network, making community interaction significant in your decision-making. States with vibrant entrepreneurial ecosystems, coworking spaces, and regular meetups can provide the connections you need to thrive, even as a remote employee. Cities like Austin and Denver foster such environments, offering both personal and professional benefits.

Networking can open doors to collaborations, mentorships, and new job opportunities that can enhance your career trajectory. In vibrant communities, you’re more likely to encounter like-minded individuals who share your interests, engage in creative endeavors, and support each other’s professional ambitions. Being part of a community helps combat the isolation that can come with remote work, contributing positively to your mental health and overall job satisfaction.

Discover more about hidden costs of moving to enhance your knowledge.

The Future of Remote Work and Taxation Trends

The ongoing evolution of remote work signifies a transformation in taxation trends. As more individuals embrace the work-from-anywhere model, states are adjusting their tax policies to attract remote talent. You can explore 9 States With No Income Tax, which could become increasingly appealing as remote work solidifies its presence in the economy. These changes in taxation strategies will likely influence where remote workers choose to establish their residence in the coming years.

Legislative Changes That Could Impact Low-Tax States

States are continuously adapting their tax codes in response to changing demographics and workforce needs. Legislative adjustments, such as introducing or modifying tax incentives, can significantly affect low-tax states’ attractiveness to remote workers. For instance, some states may implement new tax breaks for telecommuters, while others might revise their corporate tax structures to draw in larger tech companies, creating ripple effects that could accommodate your remote working needs.

The Shift in Remote Work Culture and Its Implications

The rise of remote work culture has unveiled new opportunities and challenges for both workers and states. As you navigate this landscape, consider how different regions respond to this shift. States that embrace the flexibility and innovation of a remote workforce can capitalize on the influx of skilled workers seeking a better work-life balance. Future tax policies may thus align more closely with the needs of the remote community, fostering economic growth and enhancing overall living conditions.

This cultural shift leads to an increased demand for policies that cater to remote workers, such as improved internet infrastructure and local amenities that suit your lifestyle. States that successfully align with these changing preferences will attract a dynamic workforce, whilst those resistant to change might find themselves losing out on the benefits of remote collaboration. The future landscape will likely feature an amalgamation of competitive tax incentives, heightened quality of life considerations, and evolving regulations designed specifically for a mobile workforce.

Explore our relocation impact guide for best to understand the broader context.

Conclusion: Best Low-Tax States for Remote Workers

Ultimately, choosing the best low-tax states for remote workers can significantly impact your financial well-being. By considering states with favorable tax structures, you can optimize your earnings while enjoying a higher quality of life. States like Florida, Texas, and Wyoming offer appealing advantages that align with your lifestyle and financial goals. As you evaluate your options, keep in mind how local tax policies can enhance your remote work experience and contribute to your overall satisfaction.

What are the best low-tax states for remote workers?

The best low-tax states for remote workers include Florida, Texas, and Washington. Florida is popular due to its lack of state income tax, making it especially appealing for those with higher incomes. Texas also has no state income tax and offers a diverse job market and affordable living. Washington, while imposing a sales tax, does not have a state income tax, which balances out for many remote workers, especially those in tech industries based in Seattle.

How do state taxes affect remote workers’ earnings?

State taxes can significantly impact remote workers’ take-home pay. States with no income tax allow workers to keep more of their earnings, enhancing financial flexibility. On the other hand, states with high income tax rates may reduce net income, even if the gross salary is attractive. Remote workers should consider both income tax and other taxes, such as property and sales taxes, which could affect overall living costs in their chosen state.

Are there other factors to consider when choosing a state with low taxes for remote work?

Absolutely. In addition to tax rates, remote workers should consider cost of living, quality of life, internet infrastructure, and the availability of coworking spaces. Access to amenities like healthcare, networking opportunities, and recreational activities also play a significant role in overall satisfaction. Some low-tax states may offer less in terms of public services or infrastructure, which can impact daily life and productivity.