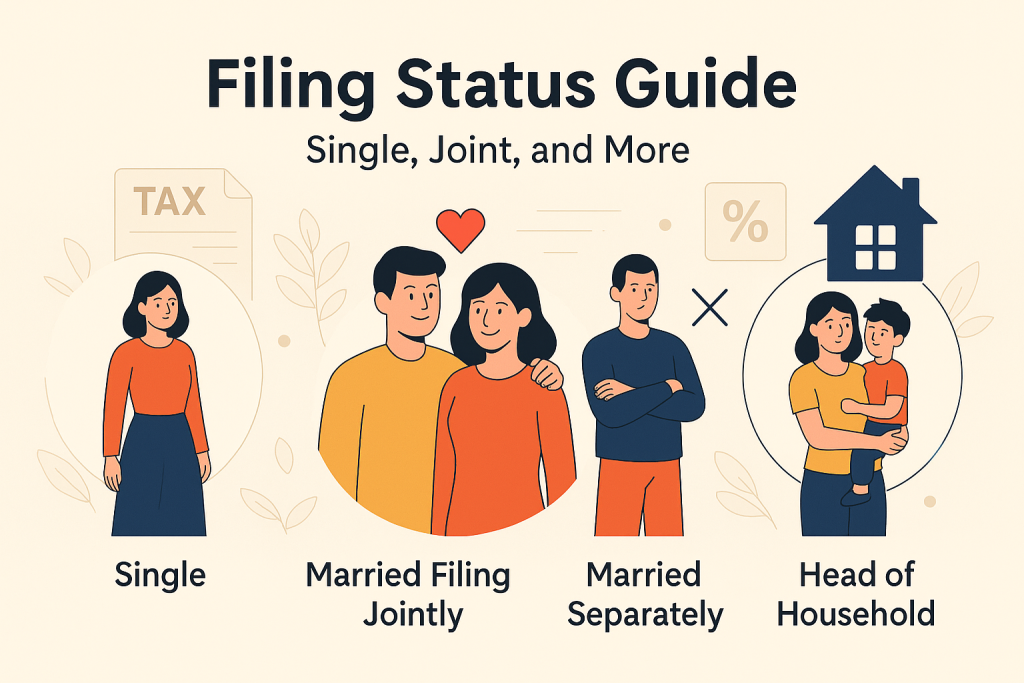

Filing Status Guide – Single, Joint, and More

Most taxpayers find themselves confused about their filing status, which can significantly impact your tax obligations and potential refunds. Understanding whether to file as Single, Married Filing Jointly, or any other status is important for maximizing your benefits and complying with tax laws. This guide will walk you through the nuances of each filing status, ensuring you can make informed decisions that align with your financial situation. You’ll gain clarity on how to choose the best option for your unique circumstances, ultimately aiding in both saving on taxes and ensuring accuracy in your filings.

Key Takeaways:

- Understanding your filing status—Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er)—is important for determining tax rates and available deductions.

- Filing jointly often provides more favorable tax benefits and deductions compared to filing separately, particularly for married couples.

- Your filing status can affect eligibility for various tax credits and can have significant implications for your overall tax liability.

The Crucial Role of Filing Status in Tax Calculations

Impact on Tax Rates

Your filing status directly affects your tax rate, which can significantly influence how much you owe. For instance, tax brackets are structured differently for single filers compared to married couples filing jointly. Single filers might find themselves pushed into a higher tax bracket sooner than joint filers, who enjoy larger income thresholds before facing higher tax rates. Understanding this dynamic is necessary for effective financial planning and minimizing tax liabilities.

Eligibility for Tax Credits and Deductions

Your filing status determines which tax credits and deductions you qualify for, affecting your overall tax burden. For example, if you qualify as Head of Household, you could potentially gain access to more favorable tax treatment compared to filing as Single. Certain credits, like the Earned Income Tax Credit (EITC), may also vary based on your filing status, impacting how much money you can keep in your pocket.

Specific tax credits are tailored to different filing statuses. As a married couple filing jointly, you can access tax benefits, such as the Child Tax Credit, with potentially larger amounts than single filers. Additionally, some deductions, like the Mortgage Interest Deduction, might only be fully available to those filing jointly, showcasing how your chosen status can open or close different avenues for tax relief. Evaluating your filing status, along with your total income and family situation, can lead you to maximize these benefits effectively.

Single Filers: Embracing Independence and Responsibility

Tax Bracket Considerations

As a single filer, your income determines your tax bracket, typically ranging from 10% to 37%. For 2023, if you earn up to $11,000, you fall into the 10% bracket; for incomes above $11,000 and up to $44,725, it’s 12%. Understanding where your income lands can help you strategize deductions and credits effectively, possibly lowering your taxable income.

Common Pitfalls for Single Taxpayers

Single taxpayers often encounter pitfalls that can lead to unexpected tax liabilities. Many overlook available deductions and credits like the Earned Income Tax Credit or Student Loan Interest Deduction. Additionally, not keeping thorough records can result in missing out on substantial tax savings.

In particular, some single filers fail to capitalize on the benefits of tax credits that can reduce their overall tax burden. For instance, the Lifetime Learning Credit or American Opportunity Credit can be substantial for individuals in school or pursuing further education. Not maintaining accurate records of expenses related to these opportunities can lead to mistakes during filing, potentially costing you money. Reviews of previous tax returns often reveal that many singles missed out on these deductions simply because they weren’t aware or didn’t claim them due to unorganized documentation. Investing time in understanding these elements ensures you navigate your tax season with confidence and efficiency.

Married Filing Jointly: Navigating the Benefits of Unity

Tax Benefits of Joint Returns

Filing a joint return can lead to significant tax benefits, including potentially lower tax rates. For example, the income thresholds for tax brackets are typically higher for joint filers, which means that a larger portion of your combined income may be taxed at lower rates. Additionally, you may qualify for various tax credits and deductions that are either unavailable or reduced for separate filers, such as the Earned Income Tax Credit and the Child and Dependent Care Credit.

When to Consider This Filing Status

This filing status is ideal for couples who want to maximize their deductions and take advantage of tax credits. If you and your spouse both earn income, combining your finances allows for greater potential savings through lower rates on your total taxable income. Furthermore, consider filing jointly if you have children or dependents, as this can enhance your eligibility for numerous tax incentives.

Evaluating your financial landscape will guide you toward the optimal choice. If one spouse has substantial medical expenses or miscellaneous deductions that exceed the 2% adjusted gross income threshold, filing jointly might allow you to claim those amounts effectively. Additionally, if you both earn moderate incomes, the tax benefits you’re eligible for when filing jointly often outweigh any separate filing considerations, making it a powerful choice in many scenarios.

Married Filing Separately: The Costs and Advantages of Segregation

Understanding the Limitations

Opting for the married filing separately status comes with its own set of limitations. For instance, you may lose access to several tax credits, such as the Earned Income Tax Credit and the Child and Dependent Care Credit. Additionally, certain deductions, like student loan interest and tuition fees, are phased out based on income thresholds that apply more stringently when filing separately. This can lead to a potentially higher tax burden compared to filing jointly.

Strategic Scenarios for Separate Filings

Choosing to file separately may be beneficial in specific situations. For example, if one spouse has substantial medical expenses, filing separately could allow that spouse to exceed the income threshold for deductible expenses more easily. Additionally, if you’re dealing with a complicated divorce or a spouse with significant tax liabilities, separate filing can sometimes protect your refund from being claimed for those debts.

For instance, if your spouse is self-employed and regularly incurs business losses, filing separately can help shield your income from their tax implications. You also might consider this approach if one spouse has large unreimbursed medical costs that exceed the adjusted gross income threshold for deductions. This enables you to maximize your potential tax deductions without being constrained by the combined income. Weighing these strategic scenarios can lead to a more beneficial financial outcome for both partners involved.

Read more about: How Filing Status Impacts Your Take-Home Pay

Head of Household: The Unsung Status for Single Parents

Requirements for Qualification

To qualify as Head of Household, you must meet three key requirements. First, you need to be unmarried or considered unmarried on the last day of the tax year. Second, you must have paid more than half of the household expenses for the year. Lastly, you must have a qualifying person living with you, such as a child or dependent relative, for more than half the year. This status recognizes the additional financial burden on single parents while providing tax relief.

Financial Advantages of Filing as Head of Household

Filing as Head of Household offers distinctive financial advantages that can significantly reduce your tax burden. Compared to single filers, the tax brackets for Head of Household are more favorable, allowing for a higher threshold before entering the next tax rate. This means you can keep more of your hard-earned money.

For example, in 2023, the tax rate for Head of Household begins at 10% for income up to $14,650, compared to 12% for single filers starting at $11,000. This translates into meaningful savings, especially for single parents managing on a tight budget. Additionally, you may also be eligible for credits and deductions not available to single filers, such as the Child Tax Credit, which can provide further relief. Overall, the Head of Household status recognizes your role and can substantially ease your tax responsibilities, making it a valuable option for many single parents.

Read more about: Single vs Head of Household: Which Saves More?

Qualifying Widow(er): Maintaining Beneficial Status After Loss

Eligibility Criteria

To qualify for the status of a Qualifying Widow(er), you must have lost your spouse within the last two years and have a dependent child living with you. It’s important that you have not remarried and have been the caretaker of your child for at least half the year. Meeting these criteria allows you to take advantage of some of the tax benefits typically reserved for married filing jointly.

The Financial Implications of This Filing Status

Opting for the Qualifying Widow(er) status offers significant financial benefits, primarily through increased standard deductions and eligible tax credits. For the tax year 2023, the standard deduction for this status is $27,700, compared to just $13,850 for single filers. This not only reduces your taxable income but can also lead to a lower overall tax rate.

Additionally, by retaining this filing status, you may be eligible for various tax credits, including the Earned Income Tax Credit and Child Tax Credit, which can further enhance your tax savings. For instance, if your dependent child meets the requirements for the Child Tax Credit, you could receive up to $2,000 per qualifying child, depending on your income level. These advantages can provide much-needed financial relief in what is often a challenging time, allowing you to manage your expenses more effectively while navigating parenthood and loss.

Read more about: When Should You Change Your Filing Status?

The Complexities of Choosing the Right Filing Status

Determining your filing status can be more nuanced than it initially appears. Each option comes with its own set of implications that could affect your tax bill, eligibility for credits, and even your financial decision-making throughout the year. While the benefits of the primary statuses—single, married filing jointly, and married filing separately—are relatively straightforward, special circumstances might complicate your choice. Understanding these can prevent missteps that lead to omitted credits or higher tax burdens.

Case Examples and Scenarios

Consider a single parent earning $55,000 annually, weighing their options against a couple earning $90,000 combined who are contemplating whether to file jointly or separately due to potential student loan implications. Each scenario highlights unique factors impacting tax liability and eligibility for potential credits or deductions, showcasing why understanding personal circumstances is vital for maximizing benefits.

Resources for Making the Best Decision

Your journey to selecting the ideal filing status can benefit greatly from various resources. The IRS website offers a wealth of tools, including interactive questionnaires and IRS publications that clarify complexities surrounding tax forms. Financial advisors and tax professionals can provide personalized insights that align with your specific situation, ensuring you make informed choices.

Additionally, tax software platforms frequently include decision-making tools that outline the consequences of different filing statuses, often providing instant comparisons of estimated tax liabilities. Many local community centers and colleges host free workshops or tax clinics, offering access to professionals who can help clarify the intricacies of filing statuses based on your unique financial landscape. Using these resources empowers you to navigate your options confidently and make an informed decision.

Read more about: Joint Filing: Benefits and Pitfalls

The Mistakes That Could Cost You: Common Missteps in Filing Status

Misunderstanding Eligibility Requirements

Confusion surrounding eligibility requirements for different filing statuses can lead to costly mistakes. For instance, many individuals misclassify their status based on relationship status or living arrangements. A common error occurs when taxpayers overlook that being considered unmarried for tax purposes necessitates certain criteria like living apart for the last six months of the year or having a dependent child. Ensuring you meet these criteria can prevent financial penalties or missing out on potential credits.

Failing to Reevaluate Each Tax Year

Your financial situation isn’t stagnant and tax laws can change, so failing to reevaluate your filing status each year can result in missed opportunities or improper filing. Annual changes in income, marital status, or dependents can altogether shift which status is most beneficial for you. Assessing your circumstances at the beginning of each tax season allows you to optimize your tax return and possibly save substantial amounts.

This reevaluation isn’t merely a routine task; it requires a thorough review of your financial landscape. For example, if you recently got married or had a child, you may qualify for filing statuses that provide better tax benefits. Even changes in income levels can impact your eligibility for credits and deductions linked to each filing status. Tax brackets and available deductions can shift yearly, so staying updated and adjusting your strategy can maximize your refund or minimize your tax bill significantly. Engaging a tax professional or utilizing tax software can provide insights tailored to your evolving situation, ensuring you’ve chosen the optimal status year after year.

Read more about: Do Married People Always Pay Less Tax?

Summing up

Upon reflecting on the Filing Status Guide – Single, Joint, and More, you now have a clearer understanding of how to choose the appropriate tax filing status for your situation. Selecting between single, married filing jointly, or married filing separately plays a significant role in your tax obligations and potential refunds. By evaluating your unique circumstances and the benefits of each status, you can make informed decisions that align with your financial goals. Make sure to review your options annually, as your filing status may change with life events.

FAQ

What are the different filing statuses available for taxpayers?

The IRS recognizes five primary filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). Each status has specific criteria and can affect your tax rates and eligibility for deductions or credits. Choosing the correct filing status is vital as it influences your overall tax liability.

How do I determine if I qualify as Head of Household?

To qualify as Head of Household, you must meet several criteria: you must be unmarried or considered unmarried on the last day of the tax year, you must have paid more than half the cost of maintaining a home for the year, and have a qualifying person living with you for more than half the year. This status often allows for a more favorable tax rate and higher standard deduction, making it beneficial for those who qualify.

What are the advantages of filing jointly as a married couple?

Filing jointly typically offers several advantages, including access to a higher standard deduction and eligibility for various tax credits that may not be available for those filing separately. Additionally, joint filers may benefit from a lower tax rate and can combine their incomes and deductions, which may facilitate a more favorable tax outcome. However, it’s important to evaluate your individual tax situation and consider consulting with a tax professional to decide the best filing status for you.