Payroll Deductions – What’s Taken Out of Your Paycheck

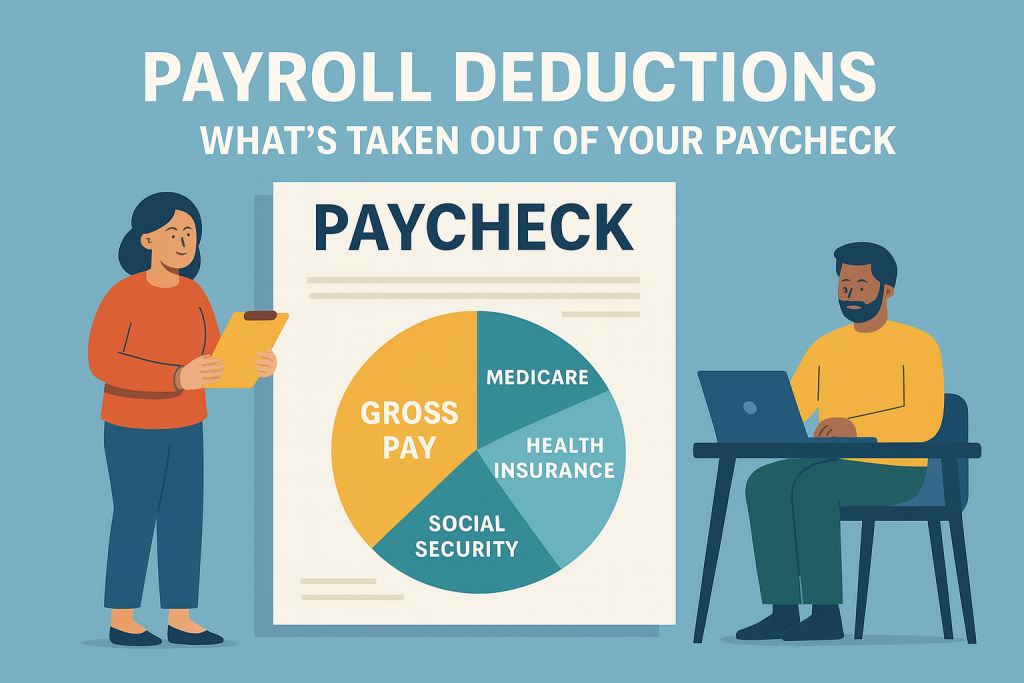

Many employees find themselves puzzled by payroll deductions and what exactly is being taken out of your paycheck each pay period. Understanding these deductions is important, as they influence your take-home pay and overall financial planning. From mandatory taxes to optional contributions, knowing what’s deducted helps you make informed decisions about your finances. In this guide, we will break down the various payroll deductions you may encounter, so you can better navigate your earnings and grasp the impact of each deduction on your paycheck.

Key Takeaways:

- Payroll deductions typically include federal and state taxes, Social Security, Medicare, and other benefits such as health insurance and retirement contributions.

- The amount deducted from your paycheck can vary based on factors such as your income level, filing status, and any additional contributions you choose to make.

- Employees have the option to adjust their withholding amounts and select specific benefits which can impact their take-home pay, so reviewing your paycheck regularly is beneficial.

The Anatomy of Your Paycheck

Decoding Gross Pay vs. Net Pay

Gross pay represents your total earnings before any deductions are taken out, including hourly wages or salary and any bonuses. In contrast, net pay is the amount you actually take home in your paycheck after all deductions have been applied. Understanding the difference between the two is fundamental to managing your finances, as net pay is what you can spend, save, or invest.

The Paycheck Formula: Calculating Take-Home Earnings

Your take-home earnings are determined by subtracting all deductions from your gross pay. The formula can be summarized as: Net Pay = Gross Pay – Total Deductions. Common deductions include federal and state taxes, Social Security, and contributions to benefits like retirement and health insurance.

To illustrate, if you earned $5,000 in gross pay for a month, and your total deductions amounted to $1,200 (including all taxes and benefits), your net pay would be $3,800. It’s vital to keep track of these deductions, as they can significantly impact your financial planning. Additionally, being aware of any changes in your income or deductions, such as tax rate adjustments or changes in health insurance contributions, allows you to anticipate and adapt your budget accordingly.

Mandatory Payroll Deductions: What You Can’t Escape

Federal Income Tax: The Government’s Share

The federal income tax is a mandatory deduction that directly contributes to the government’s operations and services. Depending on your income level, your tax rate can vary significantly, often ranging between 10% to 37%. This deduction is calculated using the IRS withholding tables, and it’s important to note that your personal circumstances—like your tax filing status or the number of allowances claimed on your W-4 form—can influence the amount withheld from your paycheck.

Social Security and Medicare: Funding Your Future

Social Security and Medicare taxes, often referred to as FICA, provide imperative benefits for retirees, disabled individuals, and certain survivors. Currently, 6.2% of your wages goes toward Social Security, while 1.45% is allocated for Medicare, with an additional 0.9% tax on high earners. These contributions may seem like a burden now, but they act as a safety net for your future, providing critical financial support in retirement or unexpected medical situations.

Understanding FICA contributions reveals just how crucial they are to your financial security. For example, as of 2023, the Social Security Administration estimates that nearly 178 million workers contribute to the Social Security fund, which plans to disburse more than $1 trillion in benefits to retirees and disabled individuals. Additionally, Medicare plays a vital role in covering healthcare costs for those over 65, alleviating financial strain during a period when medical expenses can rise sharply. By contributing now, you’re not only securing your own future but also supporting a system that helps millions of Americans each year.

Optional Deductions: Choices That Impact Your Paycheck

Retirement Contributions: Investing in Your Future

Setting aside a portion of your earnings for retirement is a vital step toward financial security. Many employers offer retirement plans, such as a 401(k), which often includes matching contributions up to a certain percentage. By opting in, you not only save for your future but also benefit from tax advantages, as these contributions are typically made pre-tax, reducing your taxable income.

Health Insurance Premiums: Protecting Your Well-Being

Health insurance premiums are another optional deduction that can significantly affect your take-home pay. Most employers provide various health insurance plans, allowing you to select the coverage that best fits your needs. While this means a reduction in your paycheck, having health insurance is invaluable in managing medical expenses and ensuring you receive timely care. When enrolling in a health insurance plan, the premium you choose can vary greatly based on factors like coverage level and family size. Basic plans may be more affordable but could involve higher out-of-pocket costs when seeking care. In contrast, comprehensive plans often come with lower deductibles and co-payments, offering better long-term savings despite higher monthly payments. Balancing these factors is crucial as you work toward ensuring you and your family’s health without straining your finances.

The Role of Tax Withholding: Ensuring You Pay Your Due

The W-4 Form: How to Adjust Your Withholding

The W-4 form is your tool for adjusting how much federal income tax is withheld from your paychecks. By submitting a new W-4, you can account for changes in your personal situation, such as marriage, a new job, or the birth of a child. When you increase your withholding, more money is taken out for taxes, which can prevent any surprises during tax season.

Understanding Your Tax Bracket: Impact on Paychecks

Your tax bracket determines the percentage of your income that is taxed. Knowing your tax bracket helps you understand how much of your paycheck goes to federal taxes. Tax brackets are structured progressively; for example, as of 2023, single filers earning between $44,725 and $95,375 fall into the 22% tax bracket, meaning only the income within that range is taxed at that rate.

Consider this – if you earn $80,000 a year, only a portion of that income is taxed at 22%, resulting in a more nuanced tax contribution than just relying on a flat percentage. This structure encourages you to strategize around deductions and withholding adjustments, which may help lower your overall tax burden throughout the year. Being proactive about understanding your tax obligations can ultimately reflect positively on your financial well-being and allow you to maximize your take-home pay effectively.

Read more about: What Are Common Payroll Deductions?

The Consequences of Mismanaged Deductions

Under-withholding: What Happens at Tax Time

If you find yourself with under-withholding throughout the year, you may face a hefty tax bill come April. This can lead to a financial strain when you are required to pay the IRS all at once, plus possible penalties and interest. The balance owed could be substantial, depending on the amount of income you failed to report, so frequent adjustments to your W-4 might be necessary to avoid this pitfall.

Over-withholding: Your Money in Limbo

Over-withholding can mean that too much of your hard-earned money is being sent to the government, resulting in less cash in your pocket during the year. While you may receive a refund later, that doesn’t solve the short-term impact on your financial stability. Essentially, you are lending your money to the government without any interest while you wait for your tax return.

For many, this situation can feel frustrating, as your income decreases unnecessarily due to inflated deductions. Consider this: you may forfeit potential investment opportunities or savings growth by having your money tied up with the IRS when it could have been earning interest or funding personal projects. Adjusting your withholding correctly allows for better cash flow management and puts you in control of your finances, ensuring you have what you need when you need it.

Read more about: 401(k), HSA and Insurance: Pre-Tax or Post-Tax?

Strategies for Optimizing Your Paycheck Deductions

Efficient Planning for Retirement and Health Expenses

Contributing to retirement accounts like a 401(k) or IRA not only prepares you for the future but can also reduce your taxable income for the current year. By maximizing your contributions, you lower your take-home pay, which may feel restrictive now but benefits you long-term. Likewise, utilizing health savings accounts (HSAs) allows you to set aside pre-tax dollars for health expenses, lessening your overall tax burden while promoting savings for medical costs.

Using Flexible Spending Accounts to Maximize Income

Flexible Spending Accounts (FSAs) empower you to use pre-tax dollars for qualified medical expenses, effectively stretching your earnings further. Each year, you can decide on a contribution amount, and once it’s set, you utilize those funds throughout the year for diverse health-related costs including prescriptions, over-the-counter medications, and even some dental and vision expenses. As these contributions lower your taxable income, you enjoy what is necessaryly a discount on healthcare costs.

Notably, contributing to an FSA can provide significant tax savings. For example, say you set aside $2,500 for the year. If you’re in the 22% tax bracket, that effectively saves you $550 in taxes, enhancing your budgeting capabilities. Additionally, some employers may offer matching FSA contributions, which can further boost your available funds. Keep in mind, however, that any unused funds typically do not roll over to the next year, prompting careful planning to maximize your benefit from this valuable tool.

Read more about: How to Read Your Pay Stub Deductions

The Future of Payroll Deductions in an Evolving Workplace

The Impact of Remote Work on Deductions

The shift to remote work has significantly influenced payroll deductions, particularly concerning location-based taxes and benefits. You might find that living in a different state while working for a company based elsewhere alters your withholding obligations. Additionally, remote employees often discover flexibility in choosing benefits that cater specifically to their home work environment, impacting deductions for health insurance and retirement plans.

Trends in Payroll Technology: Automation and the Gig Economy

Advancements in payroll technology are shaping how deductions are managed, particularly with the rise of the gig economy. You may notice platforms offering automated deduction services that cater to freelancers and independent contractors, streamlining tax withholdings and benefit contributions.

As more businesses embrace payroll automation, enhanced software solutions are emerging to handle complex deductions efficiently. For example, systems now integrate real-time data to adjust withholdings for freelance workers based on hours worked and income fluctuations. Moreover, companies are developing tailored solutions for gig economy workers, allowing them to set aside funds for retirement and health benefits through automated deduction features. Embracing these technologies not only simplifies your financial management but also empowers you to optimize your deductions seamlessly.

Read more about: Can You Control Your Payroll Deductions?

Understanding the Legal Landscape of Payroll Deductions

Federal Regulations: What Employers Must Adhere To

Employers must comply with various federal regulations regarding payroll deductions to ensure legality and fairness. The Fair Labor Standards Act (FLSA) outlines specific guidelines that employers must follow, such as limits on deductions for things like uniforms and tools, which cannot reduce your earnings below the minimum wage. Additionally, federal tax withholdings, including Social Security and Medicare contributions, are mandatory and must be accurately calculated and deducted from your paycheck.

State-Specific Variations: Navigating Local Laws

Each state has unique laws that affect payroll deductions, making it necessary for you to understand your local regulations. Some states may mandate employee benefits, such as paid sick leave or disability insurance, which could affect your paycheck deductions. Compliance with local laws not only affects the deductions made but also shapes how much net pay you ultimately receive.

For instance, California requires employers to provide contributions to the state’s Disability Insurance program, which is reflected in your deductions. In contrast, states like Texas do not impose such mandatory deductions, allowing for less complexity in your paycheck. Your understanding of these state-specific variations can empower you to advocate for your rights and ensure your deductions are both appropriate and legal, helping to avoid unexpected surprises in your paychecks.

Read more about: Deduction Planning to Maximize Net Pay

To wrap up

Considering all points, understanding payroll deductions is imperative for managing your finances effectively. From federal and state taxes to benefits like health insurance and retirement contributions, each deduction plays a significant role in your overall financial picture. By familiarizing yourself with what’s taken out of your paycheck, you can make informed decisions about your budget and long-term financial planning. Stay proactive in reviewing your pay stub regularly to ensure accuracy and alignment with your financial goals.

FAQ

What are payroll deductions?

Payroll deductions are amounts that are subtracted from an employee’s gross earnings to cover various expenses and obligations. These deductions can include federal and state taxes, Social Security and Medicare contributions, retirement plan contributions, health insurance premiums, and other benefits offered by the employer. The net pay that a worker receives is the remainder after all deductions are applied.

How do taxes impact my paycheck deductions?

Taxes are one of the primary components of payroll deductions. Federal income tax is typically withheld based on the information you provide on your W-4 form, including your filing status and number of allowances. State income taxes may also be deducted, depending on your state’s requirements. In addition to these, payroll taxes for Social Security (6.2% of wages up to a certain limit) and Medicare (1.45% of all wages) are automatically withheld as required by federal law. This tax withholding ensures compliance with government regulations and funding for social programs.

Can I control which deductions are taken from my paycheck?

Yes, employees often have the ability to manage certain deductions from their paychecks. For instance, you can adjust your tax withholding by submitting a new W-4 form to your employer, which changes the amount of federal tax withheld based on your personal circumstances. Similarly, you may choose to enroll or opt out of benefits like health insurance, retirement contributions, or flexible spending accounts, which affect your take-home pay. It’s advisable to regularly review your deductions during open enrollment periods or when your financial situation changes to ensure they align with your needs.